Homeownership dreams often crash against harsh financial realities when buyers face steep upfront costs. Down payment requirements, closing costs and related expenses block countless families from purchasing homes. Fortunately, down payment assistance programs are reshaping how Americans approach homebuying.

Most mortgage programs demand thousands in savings before house hunting begins. Families postpone homeownership for years while scraping together funds. In today’s market, down payments commonly range from $20,000 to $50,000 or more, creating barriers that feel impossible for many working families to overcome.

What Is JOLT Down Payment Assistance?

JOLT delivers meaningful down payment assistance designed to accelerate your path to homeownership. This program can cover down payments and closing costs with little to no upfront cash and does not impose income limits, making it accessible to a wide range of buyers.

JOLT pairs with FHA loans for owner-occupied property purchases and welcomes both first-time and repeat homebuyers. This flexibility sets it apart from many traditional assistance programs that limit eligibility.

Funding comes from qualified nonprofit organizations and operates under strict agency and federal lending guidelines, ensuring program reliability and borrower protection.

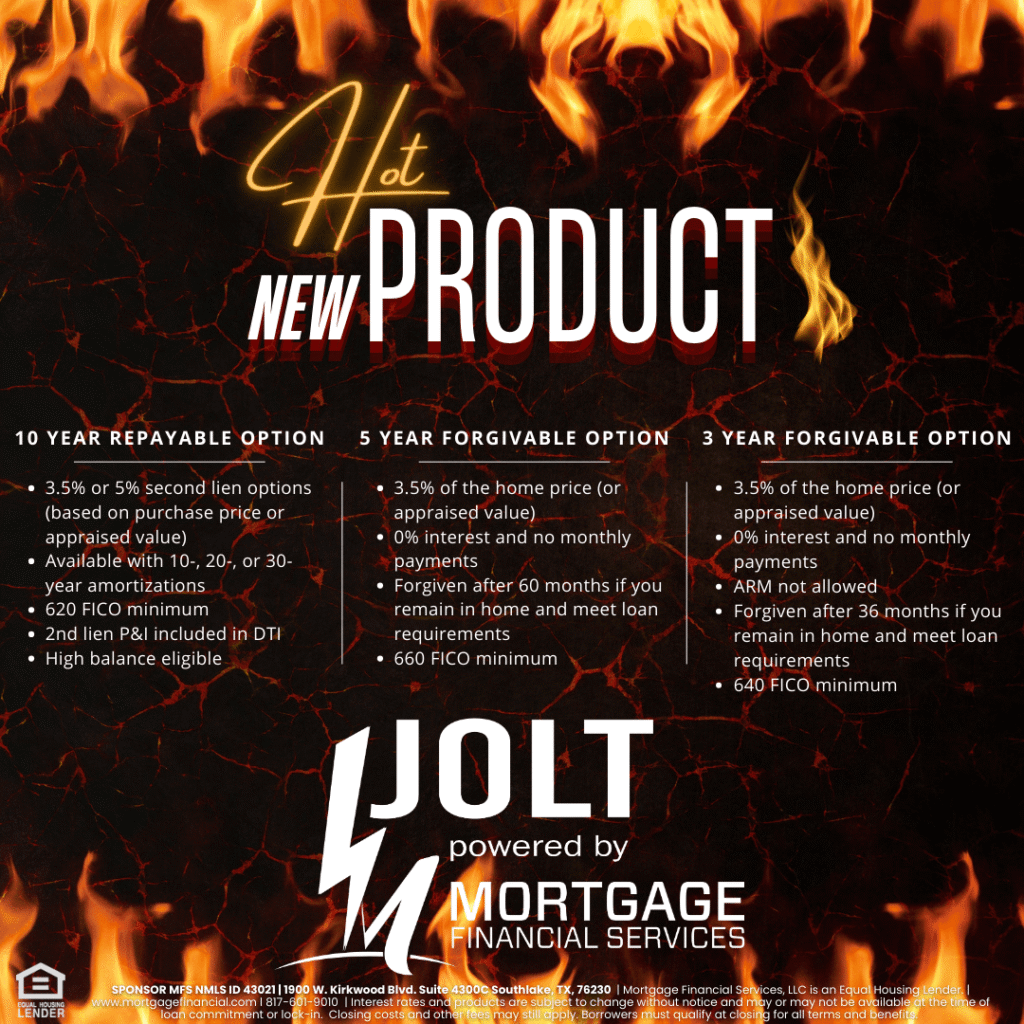

Three Flexible Options to Meet Your Needs

JOLT offers three distinct assistance structures, allowing borrowers to choose the option that best aligns with their financial goals, credit profile and length of time they plan to remain in the home.

3-Year Forgivable Option

This option provides 3.5% of the home’s purchase price or appraised value toward down payment assistance.

- 0% interest

- No monthly payments

- Forgiven after 36 months if the borrower remains in the home and meets loan requirements

- ARM loans not allowed

- 640 minimum FICO score

This structure is ideal for buyers who anticipate shorter-term ownership but still want significant upfront assistance without monthly repayment obligations.

5-Year Forgivable Option

This option also offers 3.5% of the purchase price or appraised value for down payment assistance through a second lien.

- 0% interest

- No monthly payments

- Forgiven after 60 months if the borrower maintains the home as a primary residence and remains current on the first mortgage

- 660 minimum FICO score

Separate loan numbers apply to the second lien, and restrictions on resubordination and additional liens remain in place. Under certain qualifying conditions, assumability may be permitted.

10-Year Repayable Option

For borrowers seeking repayment flexibility or potentially higher assistance amounts, the repayable option offers expanded structures.

- 3.5% or 5% second lien options

- Available with 10-, 20-, or 30-year amortizations

- 20- and 30-year terms include 10-year balloon features

- 620 minimum FICO score

- Second lien payment included in debt-to-income calculations

- High-balance loan eligible

This option supports higher-priced homes and borrowers who prefer structured repayment over forgiveness timelines.

Key Benefits of JOLT

JOLT removes one of the biggest barriers to homeownership: the need for large upfront cash reserves. By eliminating or significantly reducing out-of-pocket requirements, qualified buyers can move forward sooner rather than waiting years to save.

Unlike many assistance programs, JOLT has no income caps, recognizing that affordability challenges affect buyers across income levels—especially in competitive and rapidly appreciating markets.

Funds may be used toward down payments, closing costs and prepaid expenses, including certain items paid outside of settlement. In many cases, buyers only need to cover earnest money and inspections.

Repeat buyers are also eligible, acknowledging that homeowners relocating or upsizing often face the same financial hurdles as first-time purchasers.

Eligibility Requirements

JOLT eligibility focuses on promoting sustainable, owner-occupied homeownership:

- Primary residence required for the duration of the second lien

- FHA automated underwriting approval required (manual underwriting not permitted)

- Minimum credit scores range from 620–660, depending on option selected

- Borrowers must have at least one valid credit score

- Eligible properties include single-family homes, condominiums and planned unit developments

- Manufactured housing is not eligible

How JOLT Transforms the Homebuying Process

Traditional homebuying often forces buyers into extended saving cycles while home prices continue to rise. JOLT eliminates the waiting game, allowing buyers to enter the market at today’s prices.

Instead of focusing on saving for years, buyers can focus on choosing the right home, location and long-term fit. In competitive markets, this speed can prevent missed opportunities and escalating prices.

By preserving savings rather than draining them for a down payment, JOLT also supports healthier long-term financial stability after closing.

Working with Mortgage Financial Services

At Mortgage Financial Services, we understand that every buyer’s situation is unique. Our team works closely with clients to identify the JOLT option that best aligns with their financial goals and homeownership timeline.

From application through closing, we provide clear guidance and hands-on support. Our commitment to personalized service has earned recognition as Flower Mound’s preferred lender and reflects our dedication to positive client outcomes.

Ready to take the next step toward homeownership? Contact us today to learn how JOLT can help you buy sooner and with confidence.

Frequently Asked Questions

Can I use JOLT if I’ve owned a home before?

Yes. JOLT is available to both first-time and repeat buyers purchasing an owner-occupied primary residence.

What happens if I sell my home before the forgiveness period ends?

If you sell before the 36- or 60-month forgiveness period is complete, the outstanding second lien balance must be repaid. Repayable option borrowers follow their agreed repayment terms regardless of sale timing.

Can JOLT be combined with other down payment assistance programs?

JOLT generally cannot be layered with other down payment assistance programs. Certain mortgage credit certificates and select buydown options may still be allowed.

Are there restrictions on the type of home I can purchase?

Eligible properties include single-family homes, condominiums and planned unit developments. Manufactured homes are not permitted.

How long does the JOLT approval process take?

JOLT follows standard FHA processing timelines. Automated underwriting helps ensure an efficient and streamlined approval process for qualified borrowers.